How Is Gross Margin Calculated: A Clear Explanation

How Is Gross Margin Calculated: A Clear Explanation

Gross margin is a financial metric used by businesses to measure their profitability. It is calculated by subtracting the cost of goods sold (COGS) from the revenue and dividing the result by the revenue. The resulting percentage represents the amount of revenue that is retained after accounting for the direct costs associated with producing the goods or services sold.

Calculating gross margin is an essential part of financial analysis for businesses of all sizes. It provides insight into the company’s pricing strategy, cost structure, and overall profitability. Understanding how gross margin is calculated and what it represents can help business owners make informed decisions about pricing, production, and investment. In this article, we will explore the calculation of gross margin in detail and provide examples of how it is used in real-world scenarios.

Understanding Gross Margin

Definition of Gross Margin

Gross margin is a financial metric used to measure a company’s profitability. It is calculated by subtracting the cost of goods sold (COGS) from the total revenue generated by a company and then dividing the result by total revenue. The gross margin is expressed as a percentage and represents the amount of money left over from revenues after accounting for the cost of producing and selling goods or services.

Importance of Gross Margin in Business

Gross margin is an essential metric that helps businesses understand their financial health and profitability. A high gross margin indicates that a company is generating more revenue than it is spending on producing and selling goods or services. This means that a company has more money left over to cover other expenses such as operating costs, taxes, and interest payments.

On the other hand, a low gross margin may indicate that a company is not generating enough revenue to cover its production and selling costs. This could be due to a variety of factors such as inefficient operations, poor pricing strategies, or increased competition.

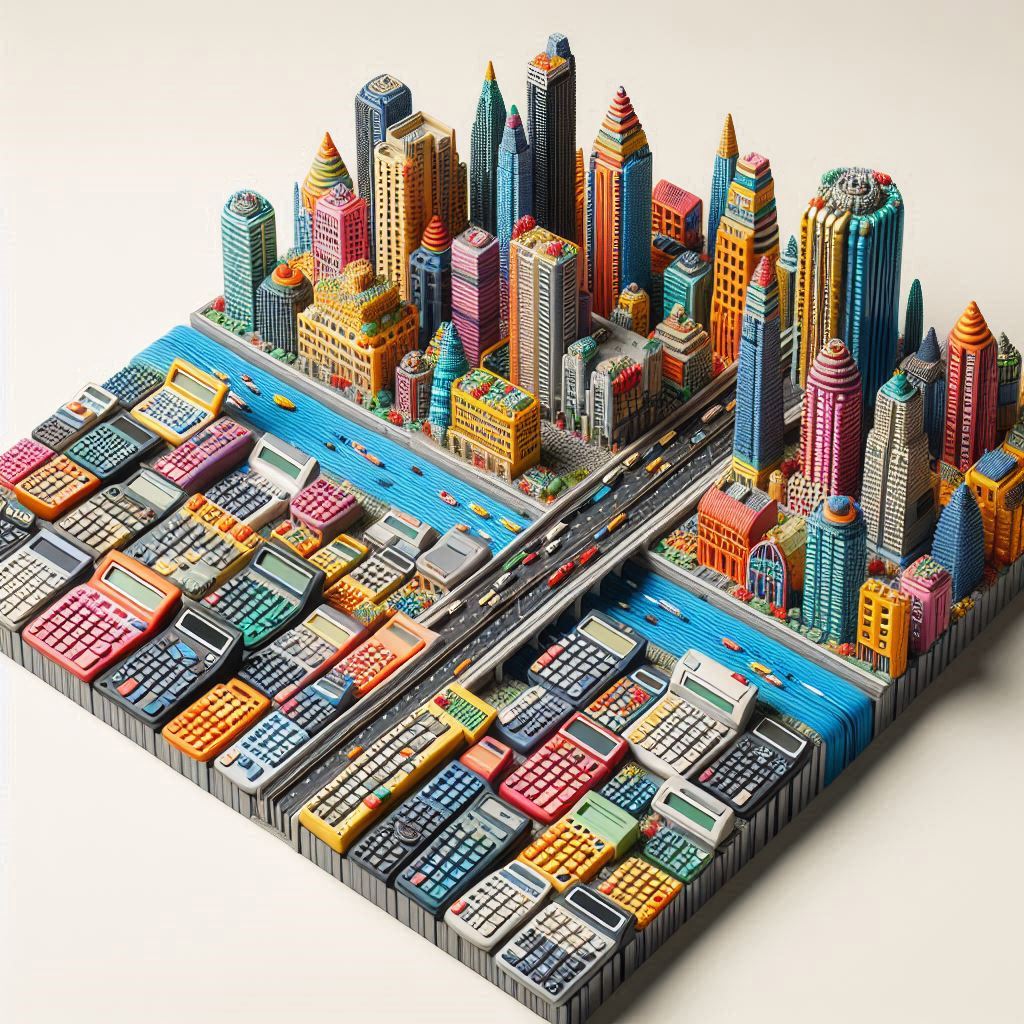

By tracking gross margin over time, Calculator City businesses can identify trends and make informed decisions about pricing, production, and sales strategies. For example, if a company’s gross margin is declining, it may be a sign that it needs to increase prices or reduce production costs to maintain profitability.

In summary, gross margin is an important metric that provides insight into a company’s financial health and profitability. By understanding how to calculate and interpret gross margin, businesses can make informed decisions about pricing, production, and sales strategies to maximize profits.

Components of Gross Margin Calculation

Revenue Recognition

Revenue recognition is the process of accounting for the revenue earned by a company. It is important to recognize revenue accurately in order to calculate gross margin correctly. Revenue is recognized when it is earned, which typically occurs when goods or services are delivered to customers.

Cost of Goods Sold (COGS)

Cost of goods sold (COGS) is the direct cost incurred in producing goods or services that have been sold. COGS includes the cost of materials, labor, and overhead expenses directly related to the production of goods or services. In order to calculate gross margin, COGS must be subtracted from revenue.

To calculate gross margin, the formula is as follows:

Gross Margin = (Revenue – COGS) / Revenue

It is important to note that gross margin is expressed as a percentage, and a higher gross margin indicates a more profitable business. By understanding the components of gross margin calculation, businesses can make informed decisions about pricing, production, and profitability.

Gross Margin Calculation Method

Step-by-Step Calculation Process

Gross margin is calculated by subtracting the cost of goods sold (COGS) from the total revenue, and then dividing the result by the total revenue. The formula for gross margin is:

Gross Margin = (Total Revenue - COGS) / Total RevenueTo calculate the gross margin, follow these steps:

-

Determine the total revenue: This is the total amount of money generated from the sale of goods or services during a specific period. It can be found on the income statement.

-

Determine the cost of goods sold (COGS): This is the total cost incurred to produce the goods or services sold during the same period. It includes the direct cost of producing the goods or services, such as raw materials, labor, and overhead costs.

-

Subtract the COGS from the total revenue: This will give you the gross profit.

-

Divide the gross profit by the total revenue: This will give you the gross margin as a percentage.

Example of Gross Margin Calculation

Suppose a company generated $100,000 in revenue and incurred $60,000 in COGS during a specific period. To calculate the gross margin, follow these steps:

-

Determine the total revenue: $100,000

-

Determine the cost of goods sold (COGS): $60,000

-

Subtract the COGS from the total revenue: $100,000 – $60,000 = $40,000

-

Divide the gross profit by the total revenue: $40,000 / $100,000 = 0.4 or 40%

Therefore, the gross margin for the company is 40%. This means that for every dollar of revenue generated, the company keeps 40 cents as gross profit after deducting the cost of goods sold.

Factors Affecting Gross Margin

Gross margin is a key metric used to evaluate a company’s profitability. It is calculated by subtracting the cost of goods sold (COGS) from the revenue and dividing the result by the revenue. Several factors can affect gross margin, including variable costs, fixed costs, and economies of scale.

Variable Costs

Variable costs are expenses that change in proportion to the level of production or sales. Examples of variable costs include raw materials, labor, and shipping expenses. As the level of production or sales increases, variable costs also increase, which can decrease gross margin. Conversely, if a company is able to negotiate lower prices for raw materials or reduce labor costs, it can increase gross margin.

Fixed Costs

Fixed costs are expenses that do not change in proportion to the level of production or sales. Examples of fixed costs include rent, salaries, and insurance. Fixed costs can have a significant impact on gross margin, as they must be paid regardless of the level of production or sales. If a company has high fixed costs, it may need to sell more units to achieve a profitable gross margin.

Economies of Scale

Economies of scale occur when a company is able to reduce its per-unit costs as production increases. This can be due to factors such as bulk purchasing of raw materials, increased efficiency in production processes, or reduced labor costs. As a result, gross margin can increase as production levels increase. However, there is a limit to the benefits of economies of scale, as production levels may eventually reach a point of diminishing returns.

Overall, understanding the factors that affect gross margin is essential for companies to make informed decisions about pricing strategies, production processes, and cost management. By carefully managing variable and fixed costs and taking advantage of economies of scale, companies can maximize their gross margin and achieve greater profitability.

Analyzing Gross Margin

Gross Margin Ratio

The gross margin ratio is a profitability ratio that measures the percentage of revenue that exceeds the cost of goods sold (COGS). It is calculated by dividing the gross margin by total revenue and expressed as a percentage. The higher the gross margin ratio, the more profitable a company is.

To illustrate, let’s take the example of a company that generates $1 million in revenue and has $500,000 in COGS. The gross margin would be $500,000 ($1 million – $500,000), and the gross margin ratio would be 50% ($500,000 / $1 million). This means that for every dollar in sales, the company retains 50 cents after accounting for COGS.

Comparison with Industry Standards

Analyzing gross margin ratios is essential for comparing a company’s profitability with industry standards. The gross margin ratio varies across industries, and it is critical to compare it with industry averages to get a better understanding of a company’s financial health.

For instance, a gross margin ratio of 30% might be excellent for a grocery store, but it could be below average for a software company. A company with a gross margin ratio above the industry average is considered more profitable than its peers.

In conclusion, analyzing gross margin ratios is a crucial step in determining a company’s financial health and profitability. Comparing gross margin ratios with industry standards provides valuable insights into a company’s performance and helps investors make informed decisions.

Improving Gross Margin

Improving gross margin is essential for any business that wants to increase profitability. There are several strategies that businesses can employ to improve their gross margin. Two of the most effective strategies are cost reduction and pricing strategies.

Cost Reduction Strategies

One way to improve gross margin is to reduce costs. There are several ways to do this, including:

- Reduce production costs: Businesses can reduce production costs by finding ways to produce goods or services more efficiently. This can be achieved by streamlining processes, reducing waste, and using cheaper materials.

- Negotiate with suppliers: Businesses can negotiate with suppliers to get better prices on raw materials or other supplies. This can help reduce production costs and improve gross margin.

- Reduce overhead costs: Overhead costs can be a significant drain on a business’s resources. Businesses can reduce overhead costs by finding ways to operate more efficiently, such as reducing energy consumption or outsourcing non-core functions.

Pricing Strategies

Another way to improve gross margin is to implement pricing strategies. There are several pricing strategies that businesses can use, including:

- Price skimming: Price skimming involves setting a high price for a product or service when it is first introduced. This strategy is effective for businesses that have a unique product or service that is in high demand.

- Penetration pricing: Penetration pricing involves setting a low price for a product or service when it is first introduced. This strategy is effective for businesses that want to quickly gain market share.

- Dynamic pricing: Dynamic pricing involves adjusting prices based on market demand. This strategy is effective for businesses that operate in a highly competitive market.

By implementing cost reduction and pricing strategies, businesses can improve their gross margin and increase profitability. It is essential to carefully evaluate each strategy to determine which ones will be most effective for a particular business.

Limitations of Gross Margin

While gross margin is a useful metric for evaluating a company’s profitability, it does have some limitations. Here are a few key limitations to keep in mind:

1. Does not consider operating expenses

Gross margin only takes into account the cost of goods sold (COGS) and not other operating expenses such as overhead costs, marketing expenses, and salaries. As a result, a company with a high gross margin may still be unprofitable if it has high operating expenses.

2. Does not account for price changes

Gross margin is calculated using the current price of goods sold. If the price of goods sold changes, the gross margin will also change, even if the cost of goods sold remains the same. This can make it difficult to compare gross margins over time or between companies.

3. Does not reflect differences in business models

Different companies have different business models, which can affect their gross margins. For example, a company that sells high-end luxury goods may have a higher gross margin than a company that sells low-cost, high-volume products. However, the latter company may still be more profitable overall due to its higher volume of sales.

In conclusion, while gross margin is a valuable metric for evaluating a company’s profitability, it should be used in conjunction with other metrics and should not be relied upon as the sole measure of a company’s financial health.

Frequently Asked Questions

What is the formula for calculating gross margin?

The formula for calculating gross margin is [(Total Revenue – Cost of Goods Sold) / Total Revenue] x 100. This formula helps businesses determine the profitability of their products or services. To calculate gross margin, you need to know your company’s total revenue and cost of goods sold, which can be found in the financial statements.

How do you determine gross margin using Excel?

To determine gross margin using Excel, you can use the formula =((Total Revenue – Cost of Goods Sold) / Total Revenue) x 100. You can input the values for total revenue and cost of goods sold in separate cells, and then use the formula to calculate the gross margin percentage. Excel also offers other functions that can be used to calculate gross margin, such as SUM and AVERAGE.

What is the difference between gross margin and gross profit?

Gross margin and gross profit are two different measures of profitability. Gross profit is the total revenue minus the cost of goods sold, while gross margin is the percentage of revenue that remains after deducting the cost of goods sold. Gross margin is a more useful measure of profitability because it takes into account the size of the business and its revenue.

Can you give an example of gross margin calculation?

Sure, for example, if a company has total revenue of $100,000 and cost of goods sold of $60,000, the gross margin would be calculated as follows: Gross Margin = [(100,000 – 60,000) / 100,000] x 100 = 40%.

What constitutes a good gross margin percentage?

The ideal gross margin percentage varies by industry and business type. Generally, a higher gross margin percentage indicates that a company is more profitable. A good gross margin percentage depends on the company’s operating costs, pricing strategy, and competition. In some industries, a gross margin of 50% or higher is considered good, while in others, a gross margin of 30% may be more realistic.

How is gross profit margin interpreted in financial analysis?

Gross profit margin is an important metric in financial analysis because it indicates how efficiently a company is using its resources to generate revenue. A high gross profit margin indicates that a company is generating more revenue from each dollar of sales, which can be a sign of strong financial health. However, a low gross profit margin may indicate that a company is struggling to control its costs or facing competition that is driving down prices.

Responses