Should I Refinance or Not Calculator: A Clear Guide to Making the Right Decision

Should I Refinance or Not Calculator: A Clear Guide to Making the Right Decision

Refinancing a mortgage can be a smart financial move for homeowners looking to lower their monthly payments or shorten the length of their loan. However, determining whether or not refinancing is the right choice can be a complex decision that requires careful consideration of various factors such as interest rates, closing costs, and the remaining balance on the loan. A “should I refinance or not calculator” can be a useful tool to help homeowners evaluate their options and make an informed decision.

These calculators work by taking into account various financial factors such as the current interest rate on the loan, the new interest rate being offered, the remaining balance on the loan, and the closing costs associated with refinancing. By inputting this information into the calculator, homeowners can quickly see whether or not refinancing would be financially beneficial for them. However, it’s important to keep in mind that these calculators are only estimates and should not be relied upon as the sole basis for making a decision. Homeowners should also consider their long-term financial goals and consult with a financial advisor or mortgage professional to ensure that refinancing is the right choice for them.

What Is Refinancing?

Refinancing is the process of replacing an existing mortgage with a new one. The new mortgage is used to pay off the original mortgage, and the borrower is left with a new mortgage that typically has different terms and conditions. The most common reason for refinancing is to take advantage of lower interest rates, but there are other reasons why someone might choose to refinance.

When a borrower refinances, they can choose to refinance with the same lender or with a different lender. The new mortgage will have different terms and conditions, such as a different interest rate, a different length of term, or a different type of mortgage. For example, a borrower might choose to refinance from an adjustable-rate mortgage to a fixed-rate mortgage, or vice versa.

Refinancing can be a good option for borrowers who want to lower their monthly mortgage payments, shorten the length of their mortgage, or tap into their home’s equity. However, refinancing can also be expensive, as there are often fees and closing costs associated with the process. It’s important for borrowers to carefully consider the costs and benefits of refinancing before making a decision.

Overall, refinancing can be a useful tool for homeowners who want to improve their financial situation. By taking advantage of lower interest rates or using their home’s equity, borrowers can save money or achieve their financial goals. However, it’s important to carefully consider the costs and benefits before making a decision.

When to Consider Refinancing

Refinancing a mortgage can be a great way to save money on monthly payments, but it’s not always the right choice. Here are a few situations where refinancing may be worth considering:

Lower Interest Rates

If interest rates have dropped since you first took out your mortgage, refinancing can help you take advantage of those lower rates. By refinancing at a lower rate, you can reduce your monthly payments and save money on interest over the life of the loan.

Change in Financial Situation

If your financial situation has improved since you first took out your mortgage, refinancing can help you take advantage of better terms. For example, if you’ve improved your credit score, you may be able to qualify for a lower interest rate. Or, if you’ve built up equity in your home, you may be able to refinance to a shorter loan term and pay off your mortgage faster.

Change in Loan Terms

Refinancing can also be a good option if you want to change the terms of your loan. For example, if you have an adjustable-rate mortgage (ARM) and want the stability of a fixed-rate mortgage, you can refinance to a fixed-rate loan. Or, if you want to reduce your monthly payments, you can refinance to a longer loan term.

Eliminate Private Mortgage Insurance (PMI)

If you put less than 20% down when you first bought your home, you may be paying for private mortgage insurance (PMI). Refinancing can help you eliminate PMI if you’ve built up enough equity in your home. This can save you hundreds of dollars each month.

Overall, refinancing can be a smart financial move if you’re in the right situation. However, it’s important to carefully consider the costs and benefits before making a decision.

Understanding Refinance Calculators

Refinance calculators are online tools that help homeowners determine whether refinancing their mortgage is a viable option. These calculators take into account various factors such as current interest rates, loan terms, and closing costs to provide an estimate of the potential savings from refinancing.

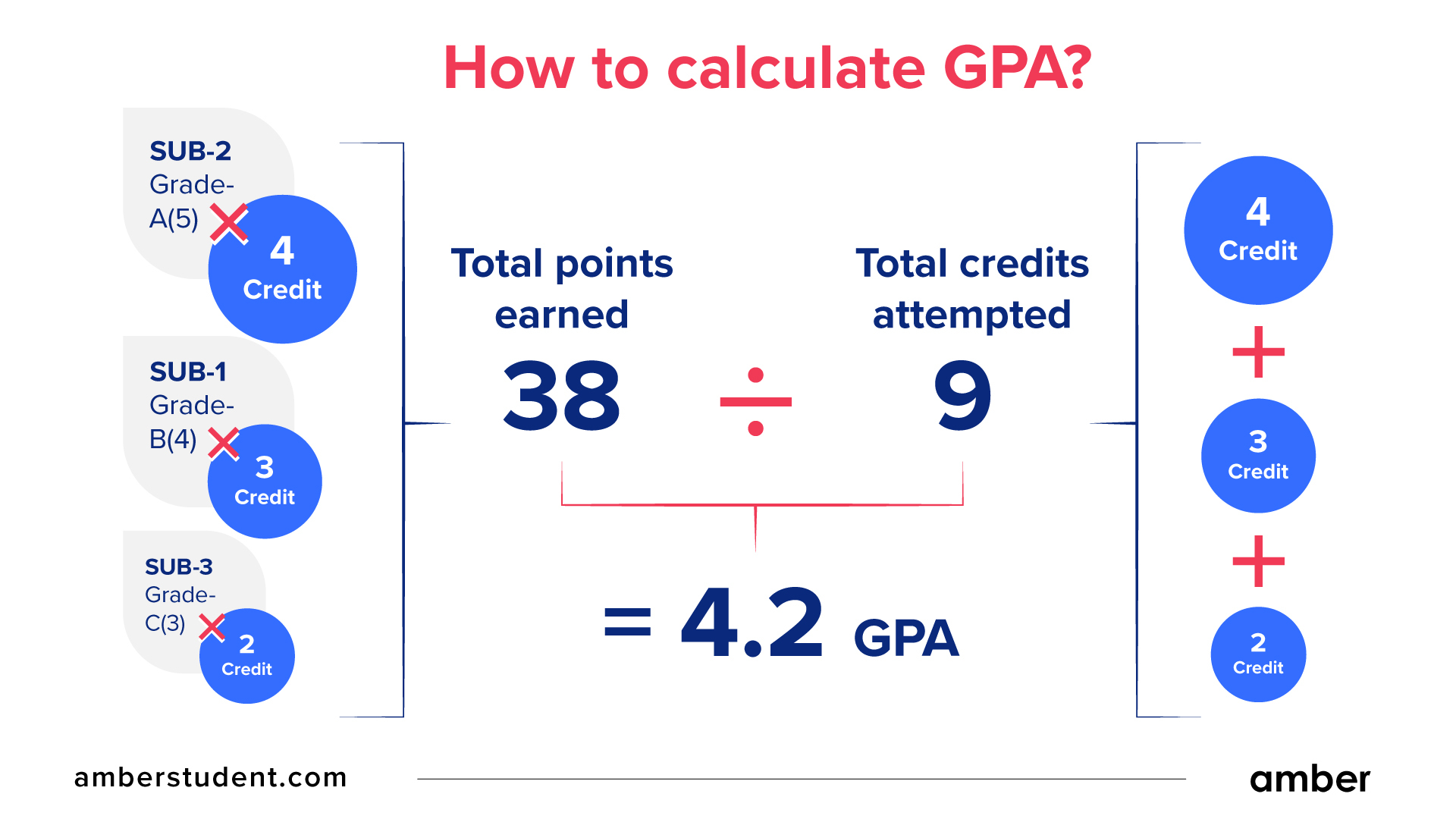

How Refinance Calculators Work

Refinance calculators work by asking users to input certain information about their current mortgage, such as the remaining balance, interest rate, and term. They also ask for information about the new loan, such as the interest rate, term, and closing costs. Once this information is entered, the calculator will generate an estimate of the monthly payment and total savings from refinancing.

It is important to note that refinance calculators are only estimates and should not be relied upon as the sole basis for making a decision about refinancing. Other factors such as the homeowner’s financial situation, credit score, and future plans should also be taken into account.

Key Inputs for Refinance Calculators

The accuracy of the estimate provided by a refinance calculator depends on the accuracy of the information entered. Some of the key inputs required by refinance calculators include:

- Current loan balance

- Current interest rate

- Current monthly payment

- New interest rate

- New loan term

- Closing costs

It is important to have accurate information on hand when using a refinance calculator to ensure that the estimate provided is as accurate as possible. Homeowners should also take the time to compare multiple refinance calculators to get a better understanding of the potential savings from refinancing.

Overall, refinance calculators can be a useful tool for homeowners who are considering refinancing their mortgage. By providing an estimate of the potential savings, refinance calculators can help homeowners make an informed decision about whether refinancing is the right choice for them.

Pros and Cons of Refinancing

Advantages of Refinancing

Refinancing a mortgage can have several benefits, including:

- Lower interest rates: If interest rates have decreased since you took out your original mortgage, refinancing can help you secure a lower interest rate, which can lower your monthly mortgage payments and save you money in the long run.

- Shorter loan terms: Refinancing can also help you switch from a longer loan term to a shorter one, which can help you pay off your mortgage faster and save money on interest payments.

- Cash-out refinancing: If you have built up equity in your home, you can use a cash-out refinance to borrow against that equity and receive a lump sum of cash. This can be used for home renovations, paying off high-interest debt, or other financial needs.

Potential Drawbacks

While refinancing can have several benefits, there are also some potential drawbacks to keep in mind, including:

- Closing costs: Refinancing a mortgage typically involves paying closing costs, which can be several thousand dollars. It’s important to factor these costs into your decision to refinance and make sure that the potential savings outweigh the costs.

- Longer loan terms: Refinancing to a longer loan term can lower your monthly mortgage payments, but it can also mean that you’ll pay more in interest over the life of the loan.

- Resetting the clock: Refinancing essentially starts the clock over on your mortgage, which means that you’ll be paying interest on your loan for a longer period of time. This can be a disadvantage if you are close to paying off your mortgage or if you want to retire soon.

Overall, whether or not to refinance your mortgage is a decision that should be made carefully and with the help of a financial advisor. It’s important to weigh the potential benefits and drawbacks and make an informed decision that aligns with your financial goals and needs.

Evaluating Your Current Mortgage

Before deciding to refinance your mortgage, it is important to evaluate your current mortgage. This includes understanding your current interest rate, monthly payments, the remaining balance, and the terms of your loan.

One way to evaluate your current mortgage is to use a mortgage calculator. Mortgage calculators can help you estimate your monthly payments, the total cost of your loan, and the amount of interest you will pay over the life of your loan. You can find a variety of mortgage calculators online, including those provided by Zillow, SmartAsset, NerdWallet, LendingTree, and Realtor.com.

Another way to evaluate your current mortgage is to review your mortgage statement and loan documents. Your mortgage statement will provide information about your current interest rate, monthly payments, and remaining balance. Your loan documents will provide information about the terms of your loan, including the length of the loan, the type of loan, and any fees or penalties associated with the loan.

It is also important to consider your current financial situation and goals. Are you looking to lower your monthly payments, reduce your interest rate, or pay off your loan faster? Understanding your financial goals can help you determine whether refinancing your mortgage is the right decision for you.

Overall, evaluating your current mortgage is an important step in deciding whether to refinance your mortgage. By understanding your current mortgage and your financial goals, you can make an informed decision about whether to refinance your mortgage and which type of loan is right for you.

Interest Rates and Market Trends

When considering whether or not to refinance a mortgage, one of the most important factors to consider is the current interest rate environment. Interest rates can have a significant impact on the cost of borrowing money, and they can fluctuate significantly over time.

One way to stay informed about current interest rates is to monitor financial news sources, such as CNBC or Bloomberg, which often report on changes in interest rates and market trends. Additionally, many lenders offer online tools that allow borrowers to track interest rates and estimate potential savings from refinancing.

Another important consideration is market trends. For example, if housing prices are rising in a particular area, it may be a good time to refinance in order to take advantage of increased equity. Conversely, if housing prices are stagnant or declining, it may be more difficult to refinance and obtain favorable terms.

Ultimately, the decision to refinance should be based on a careful analysis of the borrower’s individual financial situation, including factors such as credit score, Americredit Income Calculator, and debt-to-income ratio. By staying informed about interest rates and market trends, borrowers can make more informed decisions about whether or not to refinance their mortgages.

Calculating Your Break-Even Point

Before deciding to refinance your mortgage, it’s important to calculate your break-even point. This is the point at which the cost of refinancing is recouped by the savings in your monthly mortgage payment. Once you reach the break-even point, you’ll start saving money each month.

To calculate your break-even point, you’ll need to consider the total cost of refinancing, including closing costs, appraisal fees, and any other fees associated with the process. You can use a mortgage refinance calculator like the one provided by Bankrate to get an estimate of these costs.

Next, you’ll need to calculate your monthly savings. This is the difference between your current monthly mortgage payment and your new monthly payment after refinancing. Again, you can use a calculator like the one provided by LendingTree to get an estimate of your new monthly payment.

Once you have these two figures, you can calculate your break-even point by dividing the total cost of refinancing by your monthly savings. This will give you the number of months it will take to recoup the cost of refinancing. For example, if the total cost of refinancing is $5,000 and your monthly savings is $200, your break-even point would be 25 months ($5,000 divided by $200).

It’s important to keep in mind that the break-even point is just one factor to consider when deciding whether to refinance your mortgage. You’ll also want to consider your long-term financial goals, the terms of your current loan, and the terms of any new loan you’re considering.

Assessing Home Equity and Loan-to-Value Ratio

Before deciding whether to refinance or not, it’s important to assess your home equity and loan-to-value (LTV) ratio. Home equity is the difference between the current market value of your home and the outstanding balance on your mortgage. The LTV ratio, on the other hand, is the ratio of your outstanding mortgage balance to the current market value of your home.

To calculate your home equity, you can use the following formula:

Home Equity = Current Market Value of Home - Outstanding Mortgage BalanceTo calculate your LTV ratio, you can use the following formula:

LTV Ratio = (Outstanding Mortgage Balance / Current Market Value of Home) x 100Most lenders require a maximum LTV ratio of 80% for conventional mortgages. This means that if your LTV ratio is higher than 80%, you may have to pay for private mortgage insurance (PMI) to protect the lender in case you default on your loan.

If your home equity has increased since you purchased your home and your LTV ratio is lower than 80%, you may be eligible for a cash-out refinance. This allows you to refinance your mortgage for more than you currently owe and receive the difference in cash.

It’s important to note that refinancing your mortgage will involve closing costs and fees, which can vary depending on the lender and the state you live in. You should consider these costs when deciding whether to refinance or not.

Impact on Credit Score

Refinancing a mortgage can have an impact on a borrower’s credit score. When a borrower applies for a mortgage refinance, the lender will pull a credit report to evaluate the borrower’s creditworthiness. This credit inquiry will result in a small, temporary drop in the borrower’s credit score. According to FICO, the impact of one additional inquiry on a credit score is fewer than 5 points for most people.

However, if a borrower applies for multiple refinancing options, the impact on the credit score can be more significant. It is important to note that the impact on credit score varies from person to person, depending on their credit history.

On the other hand, refinancing can also have a positive impact on a borrower’s credit score. If a borrower is able to secure a lower interest rate with a refinanced mortgage, they may be able to pay off their mortgage faster and reduce their overall debt. This can improve their credit utilization ratio, which is the amount of credit used compared to the amount of credit available. A lower credit utilization ratio can have a positive impact on a borrower’s credit score.

It is important to consider both the potential positive and negative impacts on a borrower’s credit score before deciding to refinance a mortgage. Borrowers should also be aware of any fees associated with refinancing, such as closing costs and prepayment penalties. Using a mortgage refinance calculator can help borrowers determine whether refinancing makes financial sense for their situation.

Refinancing Costs

Refinancing a mortgage comes with various costs that borrowers need to consider before making a decision. These costs can include closing costs and other fees that can add up quickly. In this section, we will discuss the different types of costs associated with refinancing.

Closing Costs

Closing costs are fees paid to lenders and third-party service providers when a mortgage is refinanced. These costs can include appraisal fees, title search fees, credit report fees, and attorney fees. Closing costs can vary depending on the lender and the location of the property. On average, closing costs can range from 2% to 5% of the total loan amount.

Borrowers can negotiate with the lender to reduce some of these fees or opt for a no-closing-cost refinance. In a no-closing-cost refinance, the borrower does not pay upfront closing costs but instead pays a higher interest rate over the life of the loan.

Other Fees

In addition to closing costs, borrowers may also incur other fees when refinancing a mortgage. These fees can include prepayment penalties, application fees, and origination fees. Prepayment penalties are fees charged by the lender if the borrower pays off the loan early. Application fees are fees charged by the lender for processing the loan application. Origination fees are fees charged by the lender for creating a new loan.

Borrowers should carefully review the loan estimate and closing disclosure provided by the lender to understand the fees associated with refinancing. It is important to compare the total cost of refinancing with the potential savings to determine if refinancing is the right decision.

In summary, refinancing a mortgage can come with significant costs. Borrowers should carefully consider the closing costs and other fees associated with refinancing before making a decision. By understanding the costs and potential savings, borrowers can make an informed decision about whether to refinance their mortgage.

Types of Refinance Loans

When considering refinancing a mortgage, there are several types of refinance loans available. Each type offers different benefits and drawbacks, depending on the borrower’s financial situation and goals.

Rate-and-Term Refinance

A rate-and-term refinance is the most common type of refinance loan. This type of loan allows borrowers to change the interest rate and loan terms of an existing mortgage. The goal of this refinance is to lower the monthly payment, shorten the loan term, or both. Borrowers can also use this type of refinance to switch from an adjustable-rate mortgage to a fixed-rate mortgage.

Cash-Out Refinance

A cash-out refinance is a type of refinance loan that allows borrowers to access the equity in their home. This type of loan is often used to pay off high-interest debt, finance home improvements, or cover other large expenses. The borrower takes out a new mortgage for more than the existing mortgage, and the difference is paid out in cash at closing.

FHA Streamline Refinance

An FHA streamline refinance is a type of refinance loan that is available to borrowers with an existing FHA mortgage. This type of refinance is designed to help borrowers lower their monthly mortgage payments by reducing their interest rate. The FHA streamline refinance does not require an appraisal or income verification, making it a quick and easy process for eligible borrowers.

VA Refinance Options

VA refinance options are available to eligible veterans and active-duty military personnel. The VA offers several types of refinance loans, including the VA streamline refinance and the VA cash-out refinance. These loans offer competitive interest rates and flexible terms, making them a popular choice for veterans and military personnel looking to refinance their mortgage.

Overall, when considering whether to refinance a mortgage, it is important to weigh the benefits and drawbacks of each type of refinance loan. Borrowers should carefully consider their financial situation and goals before choosing a refinance option.

Deciding to Refinance: A Personalized Approach

Refinancing a mortgage can be a great way to save money on monthly payments, but it’s not always the best option for everyone. Deciding whether or not to refinance requires a personalized approach that takes into account a number of factors, such as the current interest rate, the length of time the borrower plans to stay in the home, and the borrower’s overall financial situation.

One important factor to consider when deciding whether or not to refinance is the current interest rate. If the borrower’s current interest rate is significantly higher than current market rates, refinancing may be a good option. However, if the borrower’s current rate is already low, refinancing may not result in significant savings.

Another factor to consider is the length of time the borrower plans to stay in the home. If the borrower plans to move in the near future, refinancing may not be worth the upfront costs. On the other hand, if the borrower plans to stay in the home for a long period of time, refinancing can result in significant savings over the life of the loan.

It’s also important to consider the borrower’s overall financial situation when deciding whether or not to refinance. Refinancing can result in lower monthly payments, but it can also extend the life of the loan and result in higher overall interest costs. Borrowers should carefully consider their budget and financial goals before deciding whether or not to refinance.

In conclusion, deciding whether or not to refinance requires a personalized approach that takes into account a number of factors. Borrowers should carefully consider their current interest rate, the length of time they plan to stay in the home, and their overall financial situation before making a decision.

Frequently Asked Questions

What factors should be considered when deciding to refinance a mortgage?

Several factors should be considered when deciding to refinance a mortgage, including the current interest rate, the remaining term of the loan, the borrower’s credit score, and the amount of equity in the home. Other factors that may impact the decision to refinance include the borrower’s financial goals, the costs associated with refinancing, and the borrower’s ability to make the new monthly payments.

How can I calculate the break-even point for a mortgage refinance?

The break-even point for a mortgage refinance is the point at which the savings from the new loan balance out the costs associated with refinancing. To calculate the break-even point, borrowers can use a refinance calculator, which takes into account the new interest rate, the remaining term of the loan, and the costs associated with refinancing.

What are the potential drawbacks of refinancing a home loan?

There are several potential drawbacks to refinancing a home loan, including the costs associated with refinancing, which can include closing costs, application fees, and other expenses. Additionally, refinancing may result in a longer loan term, which could increase the total amount of interest paid over the life of the loan. Finally, refinancing may result in a higher interest rate, which could increase the borrower’s monthly payments.

Is it better to refinance to a shorter loan term or a lower interest rate?

The decision to refinance to a shorter loan term or a lower interest rate depends on the borrower’s financial goals and circumstances. Refinancing to a shorter loan term may result in higher monthly payments but may also result in a lower overall interest rate and a shorter time to pay off the loan. Refinancing to a lower interest rate may result in lower monthly payments but may also result in a longer loan term.

How does a cash-out refinance differ from a standard mortgage refinance?

A cash-out refinance differs from a standard mortgage refinance in that the borrower receives cash back at closing. This cash can be used for a variety of purposes, including home improvements, debt consolidation, or other expenses. The amount of cash received is typically based on the equity in the home and the borrower’s creditworthiness.

What information do I need to use a refinance calculator without providing personal details?

Most refinance calculators require the borrower to provide basic information about the current mortgage, including the current interest rate, the remaining term of the loan, and the current monthly payment. Some calculators may also require information about the borrower’s credit score and the amount of equity in the home. However, most refinance calculators do not require the borrower to provide personal details such as their name, address, or social security number.

Responses